Navigating registration and commercialization challenges in Latin America

Supplying medical products to Latin America presents a range of challenges. From registration requirements to logistics, supply maintenance and promotion, the complexities are further exacerbated by country-specific regulations, politics, healthcare systems, and more. Tanner Pharma recognized these challenges and started the TannerLAC division over 20 years ago to serve as a partner for pharmaceutical companies looking to support patients in Latin America and other emerging markets.

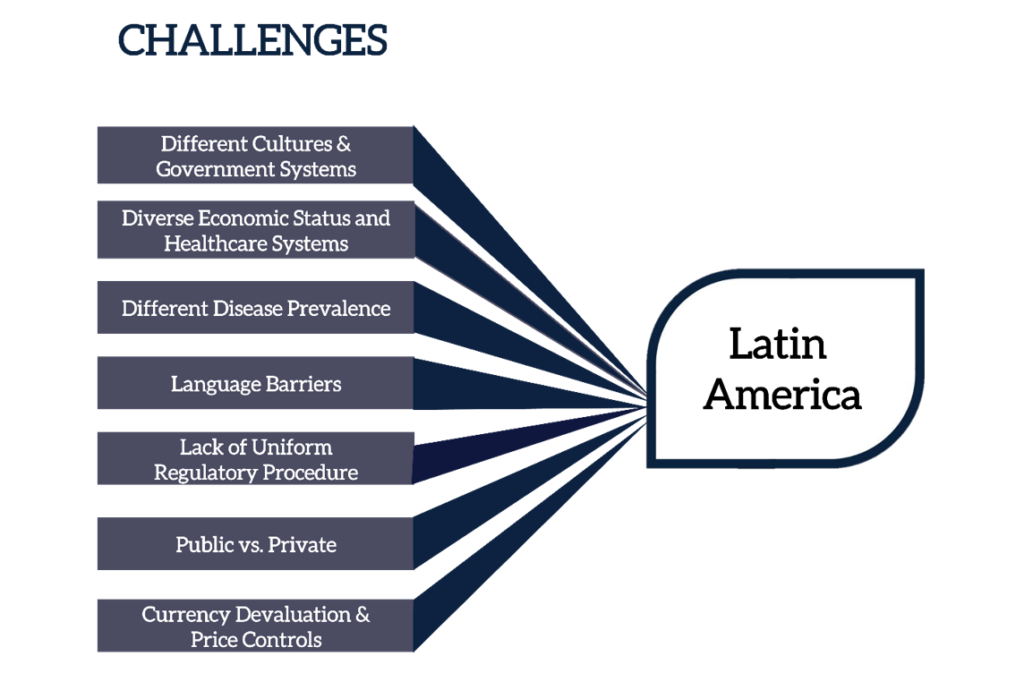

There are numerous logistical and regulatory factors pharmaceutical companies must consider when seeking to sell products in Latin America.

If not correctly managed, these factors can extend production and distribution timelines to months and even years, leading to product shortages and depriving patients of much-needed treatments. There may be a long wait for life-saving treatments or supplies may run out entirely.

The chart below only breaches the surface of some of the challenges that may be faced. However, with challenge comes opportunity. Despite the complexities, Latin America offers great opportunities for pharmaceutical manufacturers to support broader patient populations and increase ROI.

Latin America boasts large patient populations with high demand for world-class products, and the pharmaceutical market in this region is growing rapidly. Some project that the Latin America pharmaceutical market will grow with a CAGR of 7% through 2023 and reach a total value of US$76bn. The ageing population in this region also plays a role, with projections showing the 65+ population will double across the next 30 years.

Additionally, larger Latin American countries are taking steps to expedite licensing, registration and commercialization processes, elevate healthcare systems and increase transparency and opportunity through new technology.

Anvisa is now a member of the Pharmaceutical Inspection Co-operation Scheme (PIC/S), allowing Brazil to accept product inspections from some health authorities outside of the country. This makes the registration process even more efficient, waiving the on-site inspection requirement and ultimately saving companies time, money and valuable resources.

The Health Authority in Mexico, COFEPRIS, has unveiled a new platform called Trackerpris. This tool provides valuable information such as approved drugs and links to search registrations, information on the Committee of New Molecules, approved vaccines and more. This offers the population more transparency and additional tools to inform and educate.

Handling regulatory issues in Latin America

Regulations add a considerable layer of complexity to getting medical products into a Latin American country. Unlike the European Union, for example, there are regular instances in Latin America where neighboring countries operate under a completely different set of rules and regulations.

On paper, a pharma company may have taken care of everything they can control such as production and distribution. Yet severe delays can be caused by the interpretation of regulations by authorities in particular countries. Knowing how authorities in these countries interpret and apply these laws is crucial, with success almost always dependent on previous experience.

“The law may state something, but local authorities and international companies may interpret it differently. The companies that have already worked in the region and know how the system functions will be able to understand how the residing authorities will evaluate a specific matter,” adds Cortez.

Product acquisition considerations

Challenges in product registration and commercialization can also be heightened by acquisitions, especially if the acquiring company does not have access to or experience in certain markets. An acquisition and a change in supplier can sometimes mean that a medical product that has previously had regulatory approval in an area technically becomes a new product for that particular market.

And if foreign companies are acquiring a product, they may have to transfer the necessary manufacturing equipment to a different plant and notify authorities. These factors may mean that new regulatory approval is required again to sell the same product in the same market. All of this can lead to delays and uncertainty in production and supply.

Timing is also of importance. For example, when approval for a change has been granted, packaging needs to be updated to include the new information. Once this happens, there is only a limited window to sell products in the old packaging.

“You really have to consider the timelines,” says Carolina Cortez, EVP of Tanner Pharma’s Licensing, Acquisition & Commercialization (TannerLAC) division. “In Latin America, if a product has a shelf-life of less than 12 months, it is hard to be accepted by distributors.”

Having sufficient levels of support can make a dramatic difference in the success of an acquisition and minimize supply disruption.

Whether the product is newly developed, mature, newly acquired or just new to a market, TannerLAC specializes in ensuring products reach their full potential in Latin America. The division serves as a single point of contact to handle the registration and commercialization of products in the Latin America region and other emerging markets. The highly-skilled, multi-lingual team manages the entire process, taking care of regulatory requirements and any changes to market authorization to ensure supply continuity.

Local networks and a global reach

On many occasions, pharma companies may be working on a global level with little idea about what is happening on the ground in specific Latin American countries. This is where long-standing, collaborative partnerships play a big role.

TannerLAC fosters strong connections with local companies to ensure that information is up to date on the latest developments. The team stays aware of local matters and factors such as social unrest, political affairs, regulation/policy changes, or any influences that may have the potential to cause disruption.

“It’s hard for companies to communicate at a granular, more technical level. We see that many of our partners are communicating globally and at a high level, but miscommunications often occur based on technicalities and cultural misunderstandings. That’s where we can also help. We step in and keep things moving,” says Cortez. “For us to be the one to communicate directly with a local team means we can ensure understanding for both parties and minimize error, delay and disruption. With our local relationships and experience, we can keep processes moving quickly.

“Because of all the things that our team does, working with so many partners, we have a strong understanding of what is needed to ensure success for the product owner, and ensure accessibility for the patient.”

TannerLAC’s services reduce complexity, costs, and risk for companies working in pharma, biotech, and healthcare. This all helps optimize the value of a product and ensures that medical treatments get to patients.

TannerLAC’s team has built up invaluable knowledge and experience from two decades of operations in countries throughout Latin America. The team has an extensive understanding of the areas they operate in and is aware of where any potential delays could occur in advance, so can devise a strategy to mitigate any impacts.

“If things come up, we will always try to find a solution. We’re not going to take no for an answer. We explore all avenues to see if there is anything else that can be done,” adds Cortez. “There are a lot of challenges, and we want to find ways to overcome them.”

Free Whitepaper

A Guide to the Key Pharma Markets in Latin America

For pharma companies interested in product expansion, Latin America is one of the most interesting and dynamic parts of the world to establish a presence. This emerging region has many opportunities for new entrants, with a high demand for specialty pharmaceuticals, supplements, and diagnostics – and some key untapped markets. The region has a population of more than 650 million people, mostly in urban areas. In 2021, Latin America displayed the fastest regional pharmaceutical sales growth worldwide, reaching 15.6%. And growth expectations throughout the region are high. In this whitepaper we profile the key markets of Argentina, Brazil, Chile, Colombia, and Mexico. Download to learn more.